Infinant, a banking technology provider enabling banks to launch alternative growth channels, announced today that it has completed a definitive agreement to purchase Figure Pay’s Card Processing Technology, built by Figure Technologies.

The companies will also partner to deliver new card products for Figure Markets as well as Infinant’s banking partners, according to a company statement. Financial details and terms of the acquisition were not disclosed.

Infinant was founded in Charlotte, North Carolina in 2021 by banking IT executive Riaz Syed.

“We are excited to accelerate our growth as more banks launch on our Interlace Platform, and by adding these next-generation payment capabilities, we continue to offer a disruptive model for banks to expand their digital deposit and fee income channels without relying on core modernization of sidecar strategies,” said Syed.

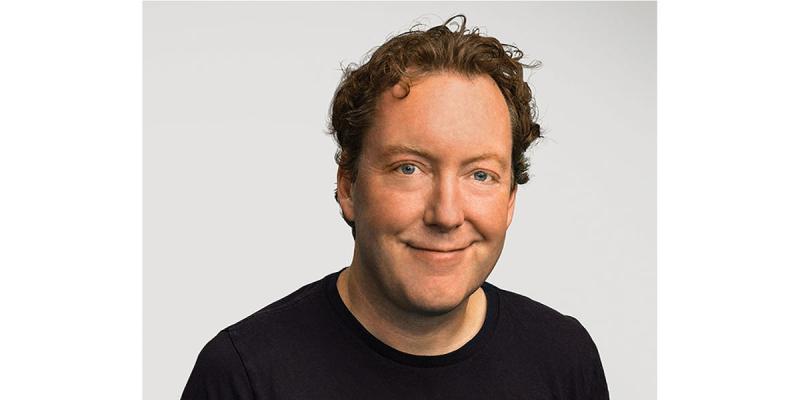

Figure Markets, co-founded in San Francisco by financial services industry veteran and former SoFi founder Mike Cagney, combines the liquidity of traditional finance with decentralized asset control. Individual and institutional investors can trade digital assets, access secure crypto-backed loans, and explore investment opportunities in a single, convenient platform, according to a company statement.

“Infinant understands the efficiencies and cost-savings unlocked by blockchain-based products, and we look forward to working together to bring those benefits to more of Figure Markets’ customers and Infinant’s banking partners,” Cagney said of the arrangement.

Through the acquisition, Infinant is adding to the company’s next-generation digital payment capabilities, including real-time debit card issuance and processing, as a native feature to Infinant’s Interlace Platform.

Infinant said it has leap-frogged standard card and payment processors by combining payment hub processing with their virtual banking platform, allowing banks to handle end-user and operating accounts on a single platform above-the-core.

While many banks rely on monolithic core systems or outsource to BaaS providers, Infinant flips the model, giving banks the ability to control their programs and maintain existing regulatory and compliance controls.

This unites banks, fintech, and regulators in a new wave of program management to start or scale their embedded banking business models.

Part of Figure Technologies, Figure Pay provides a cutting-edge card processing technology solution that drives efficiency across the card payment ecosystem.

Acquiring Figure Pay’s Card Processing Technology supports Infinant’s continued growth strategy for the Interlace Platform, which provides banks and credit unions the ability to expand distribution channels faster and maintain direct relationships with their partners (fintech and brands) to meet the evolving needs of consumers, small businesses and commercial account holders.